World trade correspondent

BBC

BBCFor many years, car-making has been the jewel in Germany’s business crown, a formidable image of the rustic’s well-known post-war financial amaze. Its “Big Three” manufacturers, Volkswagen, Mercedes-Benz, and BMW, have lengthy been praised for his or her efficiency, innovation and precision engineering. However nowadays, the German motor trade is suffering. With the faltering economic system a key think about federal elections this date, how can it get again at the street to medication?

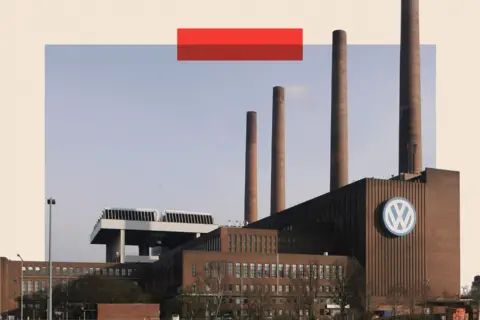

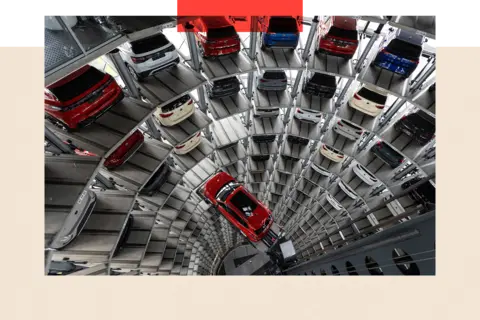

While you begin by means of teach in Wolfsburg, Decrease Saxony, the very first thing you notice is the Volkswagen manufacturing facility. Its profusion facade, emblazoned with a gigantic VW emblem and flanked by means of 4 elevated chimneys, dominates one warehouse of the canal that runs in the course of the town. The 6.5 sq km (2.5 sq mile) complicated sits adjoining to the Autostadt, a type of theme terrain dedicated to the car and to VW, Europe’s largest carmaker. The Volkswagen Enviornment, a sports activities stadium, is a snip distance away.

Wolfsburg is Germany’s resolution to mid-Twentieth Century Detroit – now not such a lot a town with a vehicle manufacturing facility as a manufacturing facility with a town that has grown up round it. Some 60,000 crowd from around the pocket paintings within the plant, occasion the city itself has a family of round 125,000. Locals say that although you don’t paintings within the manufacturing facility your self, it’s sure a lot of your folks will, along side part of your elegance from college.

Getty Photographs

Getty Photographs“Wolfsburg and Volkswagen – it’s kind of a synonym,” explains Dieter Landenberger, the VW Staff’s in-house historian, as he seems lovingly at an early fashion Beetle. It’s one in every of an array of superbly restored vintage vehicles within the Zeithaus – a profusion, glass-fronted museum within the Autostadt devoted to icons of the motor trade.

“We’re proud of the plant,” he says. “It is a symbol of that period in the 1950s when Germany had to reinvent itself and rebuild after the war. It was a kind of motor for the German economic miracle.”

As of late, alternatively, the plant has additionally come to symbolise one of the vital primary issues affecting the German vehicle trade as an entire. The Wolfsburg manufacturing facility is able to construction 870,000 vehicles a 12 months. However by means of 2023 it used to be making simply 490,000, consistent with the Cologne-based German Financial Institute. And in Germany it’s a ways from lonely. Automobile factories around the nation had been running neatly under their most capability. The selection of vehicles produced in Germany declined from 5.65m in 2017 to 4.1m in 2023, consistent with the World Organisation of Motor Car Producers.

All of this issues deeply because the German society prepares to journey to the polls on 23 February. The automobile trade is not only a supply of nationwide satisfaction; it’s also an important motive force of nationwide wealth. Disagreements over methods to get to the bottom of the rustic’s financial malaise have been an element within the shatter of the coalition govt in November. Whoever is in energy then the election will inevitably want a plan to restore the economic system – and getting the motor trade again in tools is more likely to play games an impressive function.

Automobile-making makes up a few 5th of the rustic’s production output, and if the availability chain is taken into consideration, it generates round 6% of GDP, consistent with Capital Economics. The trade employs some 780,000 crowd immediately – and helps tens of millions of alternative jobs.

It’s now not simply manufacturing this is ill. Gross sales of vehicles made by means of German manufacturers are a ways less than they have been only a few years in the past. Between 2017 and 2023, the ones of VW fell from 10.7m to 9.2m, occasion over the similar length BMW’s went from 2.46m to two.25m and Mercedes-Benz’s went from 2.3m to two.04m, corporate studies display.

All the Obese 3 noticed their pre-tax income fall by means of a few 3rd within the first 9 months of 2024, and every warned that their income for the 12 months as an entire can be less than up to now forecast.

The advance of electrical vehicles has sucked up profusion funding, however the marketplace for them hasn’t grown as briefly as anticipated, occasion international competition are flexing their muscle tissues. The warning of price lists being imposed by means of the USA and alternative governments additionally looms massive.

“There are so many crises, a whole world of crises. When one crisis is over, another is coming up,” is how Simon Shütz, a spokesman for the German Car Trade Federation (VDA) places it.

Automobile gross sales throughout Europe had been declining since 2017, consistent with Franziska Palmas, a senior Europe economist at Capital Economics. “Lately they’ve recovered a bit, but they’re still around 15 to 20% lower than they were at the peak in 2017,” she says. “That’s partly due to factors like the pandemic, the energy crisis. But it’s also cars lasting longer – and people already have a lot of cars in Europe. So demand has been weak.”

Electrical goals

Any other key issue has been the aforementioned transition to electrical vehicles. For the reason that diesel emissions scandal of 2015 – by which VW used to be discovered to have rigged emissions checks in the USA – the trade has been present process a technological revolution.

With the EU and Eu governments motivated to section out petrol and diesel vehicles over the then decade, producers have had tiny selection however to take a position tens, and jointly loads of billions of Euros on creating electrical fashions and construction fresh manufacturing traces.

Then again, even though electrical vehicles do now manufacture up an important proportion of all vehicles offered – 13.6% within the EU and 19.6% in the United Kingdom terminating 12 months, for instance – their marketplace proportion has now not been rising as briefly as expected.

Getty Photographs

Getty PhotographsAnd in Germany itself, the unexpected removing of beneficiant subsidies for electrical vehicle patrons in past due 2023 in truth contributed to a dramatic 27% fall in gross sales of all electrical vehicles throughout the nation terminating 12 months, making generation nonetheless harder for German companies of their house marketplace.

“The decision to drop subsidies suddenly – that was very bad, because it undermined trust among our customers,” says the VDA’s Simon Schütz.

“Going from the combustion engine to electric mobility is very big process. We are investing billions in rebuilding all the factories. And so that takes some time, there’s no question about it.”

A dear trade

Age all of this has been happening, German producers have additionally been grappling with some other severe fear. Doing trade in Germany itself, running factories right here and using loads of 1000’s of crowd, could be very pricey.

Employees within the automobile sector have historically loved beneficiant pay and advantages due to assurances drawn up between unions and control. Consistent with Capital Economics, in 2023 the typical per 30 days bottom wage within the German auto trade used to be about €5,300, when compared with €4,300 around the German economic system as an entire.

For years, this means gave German-based firms sure benefits, for instance in keeping off business unrest and in attracting and protecting proficient workforce. Then again, it additionally resulted in German vehicle producers having the easiest labour prices within the world trade. In 2023, those averaged €62 in step with week, in comparison to €29 in Spain and €20 in Portugal, consistent with the VDA.

The condition for Germany’s home vehicle trade become extra acute following Russia’s invasion of Ukraine. This choked off Germany’s once-abundant provides of inexpensive Russian fuel, on the very year when the rustic used to be phasing out nuclear energy.

The end result used to be a bright build up in power costs. Even supposing they’ve since subsided, power prices for business customers in Germany stay very lofty by means of global requirements. “Energy prices here are three to five times higher than in the US, or in China – much higher than for our main competitors,” says Mr Schütz.

And that is being felt around the trade, now not simply on the carmakers themselves. “From the Thysenkrupp and Salzgitter steel mills producing the sheet metal rolls that are later turned into doors and bonnets, to makers of smaller components used in drivetrains, costs have exploded as a result of high energy prices,” says Matthias Schmidt of Schmidt Car Analysis.

‘An overly fat injury’

Extreme 12 months those pressures got here to a head. At VW, which has 45% of its world workforce in Germany, managers in spite of everything made up our minds radical motion used to be wanted in order ill prices.

“It was a very big shock,” IG Metall union spokesman Steffen Schmidt tells me over a cup of espresso related the VW manufacturing facility in Wolfsburg. “The company didn’t say anything publicly.”

It used to be left to Daniela Cavallo, head of the robust VW works council and the govern staff’ consultant, in order the scoop. “They held a big meeting outside the gates of the factory. Thousands of workers – and you could have heard a pin drop,” says Mr Schmidt.

“They were stunned. Thousands of people, all completely silent.”

Getty Photographs

Getty PhotographsWhat VW proposed used to be remarkable. Union representatives had come to conferences anticipating to barter an annual pay be on one?s feet. They have been soliciting for a 7% spice up. Rather, they have been informed, the corporate wanted them to pluck a ten% pay scale down.

Worse used to be to observe. The corporate stated it could need to similar as much as 3 of its factories inside Germany itself – and used to be tearing up a role safety pledge that have been in park for many years.

Arne Meiswinkel, VW’s prominent negotiator, stated on the year that the condition it confronted in Germany used to be “very serious” and that “Volkswagen will only be able to prevail if we future-proof the company now in the face of rising costs and the massive increase in competition”.

Volkswagen had by no means up to now closed a German manufacturing facility in its 87-year historical past. Within the face of intense opposition from unions and politicians, and following snip however disruptive “warning strikes” by means of unionised employees, the theory used to be in the end shelved. However the actual fact it have been put ahead despatched a seismic injury via all the sector.

Within the interim, the team of workers did conform to painful limits on pay and bonuses, and VW stated it will scale down greater than 35,000 jobs by means of the top of the last decade, albeit in a “socially responsible manner” that have shyed away from obligatory redundancies.

Much less conspicuously, Mercedes-Benz additionally introduced a cost-cutting force terminating 12 months, aimed toward preserve a number of billion euros every year – albeit obligatory redundancies within the German team of workers are extremely not going, as a role safety pledge successfully regulations them out till 2030. In the meantime Ford, which operates two factories in Germany, lately introduced plans to scale down 2,800 jobs within the nation.

No longer the entire German vehicle trade’s issues are confined to Germany itself. With the Eu marketplace saturated, for a number of many years the continent’s producers have regarded for expansion in different places.

The affect of China

Some of the profitable markets has been China, the place for a occasion the rising center elegance had an it appears insatiable urge for food for upmarket Eu automobiles. VW, Mercedes-Benz and BMW all teamed up with native companies, putting in factories in China itself to fulfill native call for.

However now that supply of expansion is drying up. The Obese 3 have all detectable gross sales fall lately – in 2023 VW’s China gross sales have been ill 9.5% at the earlier 12 months, Mercedes-Benz’s by means of 7% and BMW’s by means of 13.4%. Their mixed proportion of the Chinese language marketplace has shriveled as neatly to 18.7%, from a height of 26.2% in 2019. This seems to be the results of a slowing Chinese language economic system, falling hobby in pricey, foreign-badged vehicles and the speedy expansion of native marques, particularly within the electrical vehicle marketplace.

“Not that long ago, Western brands represented quality and trust,” explains Mark Rainford, founding father of the Inside of China Auto web page. Then again, he says, since later the recognition and attraction of Chinese language manufacturers has stepped forward past reputation.

All the Obese 3 say developments in China have had an important affect on their income.

Getty Photographs

Getty PhotographsChinese language manufacturers also are making an attempt to assemble a proportion of the Eu marketplace, helped by means of their a lot decrease running prices than extra established opponents, each as a result of wages are decrease in China and since, as natural EV companies, they don’t have the similar legacy prices carried by means of producers making the transition from petrol and diesel to battery-powered vehicles.

Consistent with the Eu Fee, Chinese language manufacturers additionally have the benefit of hefty govt subsidies, which permit them to promote vehicles at artificially low costs. In October, the EU presented too much price lists on imports of Chinese language-made EVs, in an attempt to form a extra stage taking part in garden.

Industry wars?

German companies adverse the EU price lists, as a result of they feared retaliation from China may just impact their very own exports. Now additionally they face the warning of fresh protectionist measures being presented by means of the Trump management, together with conceivable price lists on vehicles shipped from the EU. For an trade that is predicated closely on exports, the be on one?s feet of protectionism is a rising warning.

“We know that trade wars only create losers on both sides. Tariffs will cost wealth, cost growth and cost jobs,” says the VDA’s Simon Schütz.

Even supposing one of the vital pressures going through Germany’s vehicle firms weren’t foreseeable, there used to be nonetheless a component of complacency, believes analyst Matthias Schmidt: “They knew the structural issues were there, but were blindsided by cheap Russian gas,” he says.

Getty Photographs

Getty Photographs“The expansion to China and the high profits being shipped back to Europe plastered over the high labour cost issues, giving unions a joker card to play with.

“Germany has successfully been an export-driven marketplace, and as soon as the ones markets sneeze, Germany catches a chilly, which is what’s took place.”

A high-stakes problem

So can Germany’s carmakers revive their fortunes? It is a vital question for the manufacturers, for their networks of suppliers and for the country as a whole.

“The infection for Germany is we don’t seem to be aggressive,” says Dr Ferdinand Dudenhöffer, head of the Bochum-based Center for Automotive Research. “No longer simply in charge phrases, but additionally in the case of the fresh applied sciences which can run the sector in presen”.

He thinks China has become the centre of gravity for innovation in areas such as digitisation and battery technology. “The answer for the carmakers and for the providers, personally, shall be that they pluck their factories in another country,” he says.

Simon Schütz is more optimistic. He thinks the industry can prosper, but only if it gets the support it needs from the government after the elections later this month.

“Our automobile trade shall be world-leading, I’m positive of that,” he says.

“The query is, the place will the presen jobs be? Will they be in Germany, as a result of we will be able to assemble vehicles right here, or will our firms journey in different places?’

For union rep Steffen Schmidt, alternatively, the answer is to journey again to Germany’s conventional business values. “We have to become a leader in innovation and technology again,” he says. “Then we can keep high pay and good conditions for workers.”

He thinks the trail forward for the fresh govt could be very sunny: “Invest, invest, invest. In infrastructure, in technology, in green energy and in education.”

For tens of 1000’s of employees in Wolfsburg, and in Germany’s alternative “car towns” reminiscent of Ingolstadt, Weissach, Munich, Stuttgart and Zwickau, the stakes may just now not be upper.

Supremacy image credit score: Getty photographs

BBC InDepth is the house at the web page and app for the most productive research, with pristine views that problem suppositions and deep reporting at the largest problems with the presen. And we show off thought-provoking content material from throughout BBC Sounds and iPlayer too. You’ll ship us your comments at the InDepth category by means of clicking at the button under.